EU: Examining the Effectiveness of the Generalised Scheme of Preferences (GSP)

- Arne Mielken

- Nov 25, 2023

- 4 min read

Unpacking the EU's GSP Unilateral Trade Programme: Insights from the Latest Effectiveness Report. Download the Report, a GSP Factsheet and detailed FAQs on GSP.

The EU’s Generalised Scheme of Preferences (GSP) unilaterally provides preferential access to the Union market through reduced or removed EU import tariffs, to foster the sustainable development of lower-income countries and to reduce poverty through international trade. GSP benefits are linked to beneficiary countries’ respect of international standards on human rights, labour rights, environment and climate, and good governance.

This report is a key part of the regular monitoring and reporting activities on the implementation of the GSP:

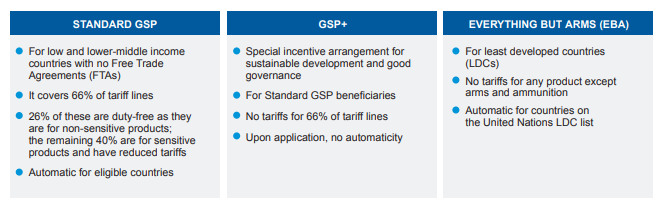

It covers the implementation and impact of the GSP over the 2020 to 2022 period (the “reporting period”) across its three arrangements:

Everything But Arms (EBA) applying to least developed countries (LDCs)

Standard GSP

and the special incentive arrangement for sustainable development (GSP+).

This report assesses the longer-term impact of the GSP, with respect to both economic effects and sustainable development, and how to ensure continued engagement in the scheme among GSP beneficiaries.

The main highlights of the report, in simple and easy to understand words are:

The GSP is a key way for the EU to help low-income countries develop in a way that is sustainable.

Also, even though exports were slower during and after the pandemic, the continued exports of GSP-benefiting countries to the EU are very important for economic stability, especially during times of crisis.

By giving more access to the EU market than the standard GSP arrangement, GSP+ effectively implements international standards in good governance, climate and environmental protection, human and workers' rights, and human and workers' rights.

The fact that Uzbekistan became a new GSP+ beneficiary during the reporting period is another sign of how appealing the programme is. Tajikistan officially applied to join the GSP+ in April 2023, and other countries are still interested in doing the same.

The GSP pushes countries that get it to join multilateral governance structures by making them follow the rules of international conventions. For GSP+, this means that countries have to ratify and effectively implement these conventions.

Many countries that benefit from the GSP have made a lot of progress in implementing and following international standards, even though they still have problems in some areas.

EU GSP monitoring and implementation work helps to make sure that basic ILO standards on workers' rights are upheld.

Investors and companies from the EU can also push for sustainable practises and international standards in GSP countries when it comes to human rights, workers' rights, the environment and climate, and good governance. However, all GSP countries need to keep working hard to reform in order to get the full benefits of the GSP, which include reducing poverty, diversifying the economy, and promoting sustainable development.

More information and downloads

The GSP 2020-2023 Report

The GSP FAQ document

The Factsheet on GSP

----------------------------------

4-In-1 Support Services: How to get more support

1. Customs & Global Trade Updates (Fee Subscription): www.customsmanager.info

2. Customs & Global Trade Consultancy & Advice (Free First Call): https://www.customsmanager.org/consultancy

3. Customs & Global Trade Training & Education: https://www.customsmanager.org/education-training

4. Compliant & efficient UK Customs Clearance: https://www.customsmanager.org/customs-agent

Connect with us on socials

X: @customsmanager

Get in Touch

· Website: www.customsmanager.org

· E-Mail: info@customsmanager.org

About Customs Manager’s Customs & Global Trade Intelligence Services

The Premium Professional Legislative Monitoring Service (PLM) is a research and curation service which checks for legislative updates from official government websites based on the selected jurisdictions and topics. Paid Plan subscribers can access regular law change notifications to ensure they never miss a significant legal change on www.customsmanager.info – a website dedicated to customs & trade intelligence. At the same time, they save valuable time by engaging our dedicated trade specialists to carry the monitoring out for them. Premium subscribers also unlock all content on the Customs Manager’s Ltd. website, including our Customs & Trade Blog on www.customsmanager.info , providing vital thought leadership development services to empower them to trade effectively, efficiently and, of course, compliantly, across borders. Premium Subscribers can add jurisdictions and topics for an additional charge.

About Customs Manager Ltd.

We aim to empower people with import, export and transport responsibilities with helpful advice, insightful training and relevant trade intelligence services. We devote all our passion and energy to helping businesses grow faster cross-border. Working with us means having your own multilingual Customs Manager on standby to help you trade effectively, efficiently and, of course, compliantly wherever you want to go. Includes Brexit support and the ability to lodge customs declarations and making sense of rules of origin, customs classification and customs valuation to make but a few.

Important Notice

Customs Manager Ltd. owns the copyright in this document, except for external documents and links we refer to or make available.

You are not allowed to use this information in any way that infringes its intellectual property rights. You may have to hold a valid licence to use this information. A licence can be obtained by becoming a Paid Plan subscriber to the Customs Managers’ Customs & Trade Intelligence service, also known as Professional Legislative Monitoring (PLM). As a Paid Plan subscriber, you may download and print this information which you may then use, copy or reproduce for your internal non-profit-making purposes. However, you are not permitted to use, copy or reproduce this information to profit or gain. In addition, you must not sell or distribute this information to third parties, not members of your organisation, whether for monetary payment or otherwise. This information is intended to serve as general guidance and not constitute legal advice. The application and impact of laws can vary widely based on the specific facts involved. This information should not be used as a substitute for consultation with professional legal or other competent advisers. Before making any decision or taking action, consult a Customs Manager Ltd. professional.

In no circumstances will Customs Manager Ltd be liable for any decision made or action taken in reliance on the information contained within this document or for any consequential, special or similar damages, even if advised of the possibility of such damages.

Comments