Search Results

1622 results found with an empty search

- New Military end-use controls in the UK

In this blog entry we discusss military end-use controls and the legal provisions. While rules depend on national legislation, we use the example of the UK export controls. What are end-use controls? The end use controls are so called catch all controls. In a nutshell, we can say that catch-all controls are case-by-case export controls on items that are not on the national export controls list, such as the UK Strategic Export Control Lists. Even though the items you want to export don't ordinarily require a licence, you may need one if export controls apply. What are Military end-use controls? These are special end use controls for specifoc products and they apply in special circumstances. Military end use controls cases apply only in specific circumstances. Case 1: The competent export controls authorities,contact you and tell you that non-controlled items (goods, software, and technology) are or may be intended for military purposes. If you now wish to export these, then you need a licence from the government. If you are "advised" that a military end-use licence is required then thhis means that the authorities (like the ECJU in the UK) told you an export licence is needed. Apply for a regular individual export licence. Do not attempting to export this under a general export licence. If authorities tell you thtat you require a licence, exporting without one is illegal. What do you understand by "military purposes"? This is non-controlled items (goods, software, and technology) thst are or may be intended for use, for production or even for testing. This also extends to analytical equipment and components for the development, production, or maintenance of military weapons. Case 2: If you, as the exporter, know that otherwise non-controlled items (goods, software, and technology) are or may be used as parts or components of military items.), then you also need to apply for a licence. If you 'know' your commodities are or may be intended for one of the stated end-uses, you must notify the ECJU, which will determine if an export licence is required. Are they any exceptions? There are usually exception, such as, Medical exports assist a country's civilian population. consumer goods export Software or technology transfer. What Criteria are used to assess my application? If any of these key ssessment questions, in summary, are answered with YES, then it is likely that a licence is denied. In no particular order: 1)Would the export to this military abroad represent a national security threat? 2) Would the export of this item to a foreign military counteract peace,reduce security, or threaten stability? 3) Could this export contribute to international law infringement 4) Is it possible and likely that this export could be used to violate human rights? 5) Would this export support terrorists or severe criminal acts? Strategic Export Licensing Criteria from the Secretary of State's Trade Policy Update will be used to evaluate licences (8 December 2021). Controlled destinations Exports to the following countries are subject to end-use controls: Armenia Azerbaijan Belarus Burma (Myanmar) Centrafrique PRC (including Hong Kong and Macao) DR Congo DPR Korea IranIraq Lebanon Libya Russia Somalia Khartoum (South Sudan) Venezuela

- What is Green Trade? Let the UK tell us...

This week, we were told that Green Trade is crucial to growing the UK economy, achieving net zero and driving our future prosperity. So the words of the UK International Trade Secretary in a speech. But what actually is Green Trade? We enquired with the Trade Secretary. At her recent speech, she gave important insights. Let's review. In a nutshell, the UK Green Trade Strategy is centered around four key principles: 1) Building a green industrial base Specifically, this means that funds will be allocated to the development of wind, hydrogen, and electric vehicles in the UK amongst others. High-value green investments will be encouraged, which will increase the country's appeal to international businesses. All of these eco-friendly products should be produced in the UK in order to help the country's economy by creating jobs and supply networks. There are already many investment opportunities available in this country, and you can learn more about them by visiting the so-called Investment Atlas. 2) Boosting green exports Britain wants to promote green product exports to create employment, boost productivity, and gain global expertise. Low-carbon sectors might export £170 billion by 2030. The UK has huge promise in renewable energy, green finance, sustainable construction, and precision agriculture. To achieve this goals businesses need money. UK Export Finance helps companies get financing to grow exports. Businesses can use the Export Development Guarantee to acquire high-value loans to boost production and exports. 3) Liberalising green trade Use the independent trade policy to liberalise green trade – a critical new tool in the UK’s armoury. Green Tariff The uk introduced the UK Global Tariff after Brexit. This reduced prices and boosted the green economy by removing duties on 100 environmental goods. Green Trade Agreements Free trade agreements and demolishing barriers to green trade will be essential. The UK-Australia trade deal is a good example. It goes further on climate than any previous one: It removes tariffs on low-carbon goods, including lithium batteries. The deal encourages green industry cooperation. Another example is the UK-New Zealand FTA as it removes tariffs on the most environmental goods. For future FTAs, the domestic and international trade and environmental goals will likely influence if a deal can be struck. Let's look out for trade deals with India, Mexico, Israel, Canada, Switzerland, and the GCC and assess how serious the UK gets about Green Trade. 4) Greater alignment of trade and environmental policies Following the UNFCCC ministerial-level conference COP26 in 2021, which also addressed the link between trade and environmental policy, the 12th WTO trade ministers meeting (MC12) in Geneva is quickly approaching. MC12 is significant because it will discuss the impact of global warming on trade via environmental policies. As countries become more aware of climate change, they implement policies that may harm other countries. Climate-related trade protectionism may disproportionately affect the least developed countries. As a result, the WTO must ensure that countries address climate and environmental issues in a way that does not negatively impact trade with other countries. All while effectively combating and mitigating the effects of climate change. Takeaway The UK is defining Green Trade and showcase its importance with a four part comprehensive strategy. This includes investment in eco friendly goods and technology, boosting green exports, liberalising carbon friendly goods (aka reducing duty to zero) and linking trade and environmental policy in a clever way without creating new trade distortions that could harm other countries. What's encouraging is that the UK has realised that protecting the environment and fighting climate change is not contrary to growing the economy and creating jobs. The opportunity arises from cleverly combining both. The UK has a strategy for it and this is to be welcomed. But - the key question remains - can the UK make a sufficiently large impact to make a difference for climate, environment, jobs and prosperity? Time will tell!

- Customs Declarations Service (CDS) - What Businesses Can Take Now!

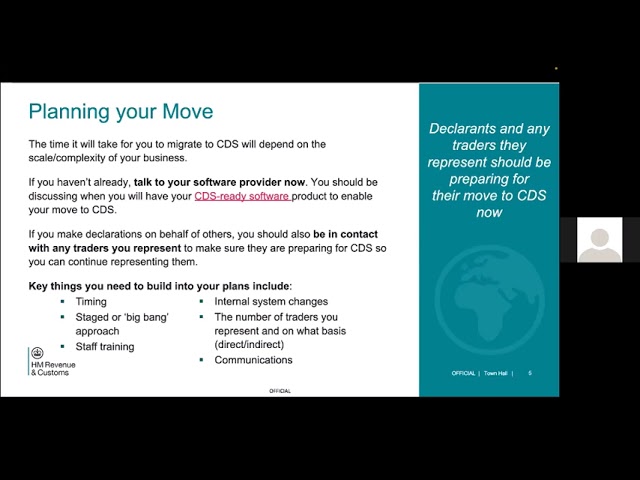

Watch HMRC explain the new Customs Declaration Service (CDS), set to enter into operation in Autumn 2022. What do you need to do? If your business is affected by this change, you need to know how it will affect you and what steps you need to take. We've put together a guide that explains everything you need to know about CDS, which you can download here: [link]. During the Customs & Global Trade Update Conference of Spring 2022, a live audience of over 100 customs and global trade experts joined HMRC for a presentation and discussion on the new Customs Declaration Services (CDS) due to enter into operation in Autumn 2022. In this video, you'll hear from HMRC, who will explain how businesses can get ready for CDS. The video covers: What is CDS? Why is it important? How does it work? How can businesses prepare themselves for its launch? Watch now: Read More Need to appoint a customs broker, agent or representative? What to think about.... Selecting the right partner to manage your imports and exports is crucial for trade success. There are some essential points to consider, argues Arne Mielken from Customs Manager Ltd. Ask the Customs Agent: Your TOP 7 customs clearance questions answered! Lodging import and export declarations must not be complicated. We answer businesses' top questions on customs clearance. Switching to the UK's CDS? Questions To Ask, Actions To Take The new UK customs declaration system is going live. In this blog, discover actions importing and exporting businesses may need to take now. How We Can Help We also offer a wide range of training and bespoke support on all things related to customs & Global Trade. Schedule a free call with us today to get practical advice from experts who understand the challenges faced by businesses like yours. www.customsmanager.org

- Need to appoint a customs broker, agent or representative? What to think about....

Selecting the right partner to manage your imports and exports is crucial for trade success. There are some essential points to consider, argues Arne Mielken from Customs Manager Ltd. Import and export declarations can be handled on your behalf by customs brokers or agents. Because customs filings may be difficult, many firms choose to hire an intermediary. You can pay someone or a company to handle customs for you, such as: freight forwarders customs agents or brokers fast parcel operators What they can do for you (and who will be liable) depends on: the services they provide what you want them to do the commercial agreement you have with them. Learn how to minimise delays, halt duty payments, and rectify false customs declarations from the outset with our broker management course, which is given in five convenient online courses including live training and a "check your knowledge" exam at the conclusion and a certificate of accomplishment. Find out more and how to book What type of relationship? They can act for you either as a: direct representative / agent indirect representative / agent They are unable to act on your behalf unless you provide them with written instructions. The command must specify whether they are operating directly or indirectly for you. Customs authorities may request proof of authorization. What shall I consider before appointing an agent? Before appointing one, there are several things to consider, such as: your company's requirements - the number of commodities moved, the sort of products moved, how frequently they are moved, and where they are moved to or from the number of declarations you plan to make for licencing whether your products require a permit, special handling, or other specialised controls Timing - If your items must arrive within a specified timetable, your customs training is required. Being clear on these points will allow you to make an informed decision when appointing an intermediary to help you with customs processes for Your business requirements Before speaking with a customs agent, make sure you have adequate information about your requirements, including what sort of items you transfer, how frequently you move them, and where you move them to or from – for example, the country with whom you frequently deal. You should think about asking your "middleman": "How much customs experience do you have?" What kind of items do you transport? Which routes/countries do you service? Can you manage the customs processes for the nations with whom I do business? How many declarations you need to make You need to know: how many declarations do you anticipate making in a week or month how frequently you transport items into and out of our nation You should also be clear about how the broker will charge for their services. Consider asking them Can you manage the number of declarations I intend to make? How would you like to be compensated (you should be able to estimate this for them)? They may, for example, impose a flat price, a fee per declaration, or both. Consider hiring Customs Manager to serve as your customs clearing agent. We provide brokerage services to our clients. Our unique selling point is that we only use fully certified customs managers and specialists to perform your customs clearance, rather than entry clerks with limited expertise. So, if you want a real customs manager who understands customs clearance to do the work for you, get in touch and explore more here. Licensing, special handling and other controls You must determine if your items require a licence, special handling, or other specialised regulations. Consider requesting confirmation from the broker that they will be able to manage your licencing requirements. Timing – goods that need to arrive quickly Think about if your goods need to arrive at their destination within a specific timeframe or need rapid or out-of-hours changes. You should consider asking the intermediary: can you prioritise declarations for goods that, for example, need to reach their destination within a specific timeframe? are you able to respond quickly to unforeseen issues that may arise while goods are being imported or exported? What you need from a broker Consider what you need your customs intermediary to perform, and what you can do yourself or have someone else do for you. You might think about asking the broker, "What is the whole range of services that you provide?" What would you and the intermediary be held accountable for? (For example, who would be in charge of import/export declarations, safety and security declarations, and transportation requirements?) Information sharing Consider the most convenient method for you to communicate information to your intermediary in order for them to act on your behalf and whether it will also work for them. You should think about asking the intermediary: What information do you require from me? How frequently will you require information from me? Can I offer the information in a method that is convenient for me? Free Videocast: Shall I appoint an agent or clear it alone? Watch this informative conversation between Business Journalist Paul and Customs Declaration Expert and "Broker Management Course" designer and leader Arne Mielken on who and how to file customs declarations. Customs Clearance Services by Customs Manager Ltd. We are experts in completing customs declarations for firms in the EU and the United Kingdom. To file customs declarations for our customers and comply with all UK fiscal filing and security filing regulations, we use leading electronic customs filing software that is directly connected to the UK's HM Revenue and Customs (HMRC). Our import, export, and transit filing services are tailored to your specific needs. Let's make it happen, whether you're a small dealer with a limited number of shipments or a huge and complicated international corporation with hundreds of shipments every week. We operate with a team of seasoned customs filing professionals, and each of our customers is assigned a Customs Manager for personalised service. Find out more: https://www.customsmanager.org/customs-filing-declaration-service Study the Course to Learn More A single blog article on this subject is absolutely insufficient. With our five-week training course, you'll gain a lot more knowledge on how to miss out on good broker advice. Find out more Get our free newsletter Head over to www.customsmanager.org and pop your e-mail address into the page for more insightful content, tips and tricks like this.

- BIFA's Guide the Customs Representation

The following information has been issued by BIFA to help their Members in understanding their legal obligations and liabilities as a Customs agent. The principal legislation controlling Customs operations will shift from EU Directive 952/2013 to the Taxation (Cross Border) Trade Act 2018 on January 1, 2021. (TCTA 2018).

- EU Sanctions On Russia: What are the top 5 questions that companies are asking? + Answers & BONUS

There are five critical questions that any EU firm working with Russia must be able to answer. You can find them right here. One of the biggest problems with EU sanctions is their complexity. The EU has a wide range of sanctions against Russia, and there are often confusing overlaps between them. Let's get the bottom of it, by answering questions that businesses and global trade professionals are actually asking. Hey, BTW if you are contemplating taking over Eastern Ukraine (or more), annexing the territory to assert sovereignty, and then reintroducing the downtrodden people of Donetsk and Luhansk into Mother Russia's loving arms, you should be aware of the sanctions imposed by the European Union. What are sanctions? Sanctions. Wars have been fought to put a stop to them, economies have suffered as a result of depending on them, and political careers have been damaged as a result of adopting them. The EU is no stranger to sanctions: in the last 50 years, the EU has sanctioned over a hundred nations and groups of persons. As a consequence, the phrase "sanctions" may refer to a variety of government actions ranging from travel bans to asset freezes and even trade restrictions. As soon as it seems that a penalty is about to be removed or has been lifted, another one is placed without notice. It's no surprise that sanctions are a hot subject in the media and in politics...especially when it comes to dealing with Russia... Why Sanctions Against Russia? Since Russia's recognition of the non-government-controlled portions of Ukraine's Donetsk and Luhansk oblasts on February 21, 2022, and the unprovoked and unlawful invasion of Ukraine on February 24, 2022, the EU has placed a slew of sanctions on Russia. They are in addition to the sanctions placed on Russia since 2014 in response to the annexation of Crimea and the failure to execute the Minsk accords. The EU denounced the "decision of the Russian Federation to recognise as independent entities and send Russian troops to certain areas of Ukraine’s Donetsk and Luhansk oblasts" as illegal and unacceptable. According to the EU, "it violates international law, Ukraine’s territorial integrity and sovereignty, Russia’s own international commitments, and it further escalates the crisis". Statement of the EU 24 February 2022 So far, what sanctions has the EU imposed? From February 2022 to May 2022, the EU has issued five packages of sanctions on Russia since February, including targeted restrictive measures (individual sanctions), economic penalties, and diplomatic measures. In reaction to Belarus's role in the invasion of Ukraine, the EU imposed sanctions on the country, too. Access a full debrief on the latest in Belarus Sanctions here. For what aim? The goal of the economic sanctions is to Punish Russia severely for its conduct Effectively block Russia's ability to continue its aggression. Target people responsible for supporting, financing or implementing actions which undermine the territorial integrity, sovereignty and independence of Ukraine or who benefit from these actions. What are the top 5 questions that companies are asking? Who can I still do business with and who not? Who can I protect my business and myself? As a business owner, what do I need to know about the trade with Russia? How are EU regulations affecting commerce with Russia, and what kind of import and export restrictions are in place? How can I still transport goods to Russia? Can I Still Get Paid? What do I need to know about trading with Crimea and the "breakaway" regions? BONUS: Other sanctions against Russia 1. Who Can I Still Do Business With and Who Not? RPS = Restricted Party Screening is required for firms interacting with Russia in order to prevent trading with certain categories of people. As of the beginning of May 2022, the EU sanctioned 80 organisations and 1093 individuals in total, including prior individual sanctions imposed following the annexation of Crimea in 2014. Please review our detailed explainer blog entry here. 2. As a business owner, what do I need to know about the trade with Russia? The EU has placed a number of import and export restrictions on Russia as part of the economic measures. Investigate what you can and cannot do. Because of the limitations, European firms are not permitted to sell certain items to Russia (export restrictions), and Russian entities are not permitted to sell some products to the EU (import restrictions). Please refer to our exclusive EU import and export guide for trade in goods with Russia. Read it here. 3. How Can I Still Transport Goods To Russia? You can't simply transfer merchandise to Russia and ignore EU sanctions regulations, can you? Otherwise, a catastro-pocalypse is a distinct possibility! And if you're still confused about the new regulations and penalties, you've come to the correct spot. The EU has recently issued fresh instructions directed primarily at airlines, yachts, and road transport providers to ensure that they are aware of the dangers involved with violating the Russia/Ukraine-related sanctions regime, which, in fact, has been in effect since July 2014. Explore the impact on planes, ships and road transport. 4. Can I Still Get Paid? To restrict the funding of escalatory and aggressive activities, the EU sanctions target banks that finance the Russian military and other operations in those regions, as well as the capacity of the Russian state and government to access the EU's capital and financial markets and services. This includes a sectoral embargo on funding Russia, its government, and its Central Bank. As a result, receiving money may be more challenging than you anticipate. Here are a few things to consider before signing a contract. Read the analysis and major choices that were made. 5. What do I need to know about trading with Crimea and the "breakaway" regions? Finding individuals responsible for the illegal and unfriendly conduct in Crimea and the two self-proclaimed republics is no easy task. As a result, the EU has amended its sanctions policy against Russia in response to their unlawful actions. So, now the EU targets commerce to and from Crimea and the two separatist regions in order to ensure that those responsible bear the economic costs of their unlawful and hostile acts. This impacts businesses which may or may not know that they trade with these regions. Read what you can and cannot do as a business owner. Takeaway Companies all throughout the world ask themselves the same Top 5 questions whenever there is a risk of fines. We went through the questions and gave answers to help you understand the sanctions imposed by the EU on Russia. Overall, it is clear that foreign firms operating in Russia face significant hurdles. And in this circumstance, it's doubtful that will change very soon. The first and most important step for any company interested in doing business with Russia is to double-check the products it produces and the marketplaces in which they are sold. If they are susceptible to these fines, customs officers who are seeking to enforce them may stop them. Next, regardless of how these sanctions effect your company's products trade, if you conduct business in Russia, you should be on the alert for other developments involving EU sanctions laws against Russia, such as payment restrictions. Individual trade or transportation restrictions The devil is in the details, but thanks to your Customs Manager subscription, you will always be up to date and knowledgeable. And if you have any questions, please contact us. BONUS1 : Other Sanctions against Russia There are a range of other sanctions imposed against Russia, too, to do with Human Rights abuses and more. Read our briefing. BONUS 2: In a Nutshell: Useful Infographics by the EU The below infographics provide a very useful overview of sanctions imposed by the EU on Russia.

- EU Sanctions: Attention - No trading with Crimea or Donetsk and Luhansk breakaway regions

The EU targets trade from Crimea and the two breakaway regions to and from the EU, to ensure that those responsible clearly feel the economic consequences of their illegal and aggressive actions. Restrictions on economic relations with the non-government controlled areas of the Donetsk and Luhansk oblasts Measures target trade from the two non-government controlled regions to and from the EU, to ensure that those responsible clearly feel the economic consequences of their illegal and aggressive actions. The EU introduced, in particular, an import ban on goods from the non-government controlled areas of the Donetsk and Luhansk oblasts, restrictions on trade and investments related to certain economic sectors, a prohibition to supply tourism services, and an export ban for certain goods and technologies. Crimea Since March 2014, the EU has progressively imposed restrictive measures in response to the illegal annexation of Crimea, Russia's decision to recognise the non-government controlled areas of Donetsk and Luhansk oblasts as independent entities and the deliberate destabilisation of Ukraine. The EU has imposed different types of restrictive measures: diplomatic measures individual restrictive measures (asset freezes and travel restrictions) restrictions on economic relations with Crimea and Sevastopol economic sanctions restrictions on economic cooperation Below you can find more information on each type of restrictive measures. Diplomatic measures In 2014, the EU-Russia summit was cancelled and EU member states decided not to hold regular bilateral summits with Russia. Bilateral talks with Russia on visa matters, as well as on the new agreement between the EU and Russia, were suspended. Instead of the G8 summit in Sochi, a G7 meeting was held - without Russia - in Brussels on 4-5 June 2014. Since then, meetings have continued within the G7 process. EU countries also supported the suspension of negotiations over Russia's joining the Organisation for Economic Co-operation and Development (OECD) and the International Energy Agency (IEA). Individual restrictive measures Asset freezes and travel restrictions 555 people and 52 entities are subject to an asset freeze and a travel ban because their actions have undermined Ukraine's territorial integrity, sovereignty and independence. The list of sanctioned persons and entities are kept under constant review and are subject to periodic renewals by the Council. These measures were introduced in March 2014. They were last extended until 15 March 2022. List of persons and entities under EU restrictive measures over the territorial integrity of Ukraine (Official Journal of the EU) Misappropriation of Ukrainian state funds In March 2014, the Council decided to freeze the assets of individuals responsible for the misappropriation of Ukrainian state funds. These measures were last extended in March 2020 until 6 March 2022. Restrictions on economic relations with non-government controlled areas of Donetsk and Luhansk The Council adopted restrictive measures in response to the decision by the Russian Federation to proceed with the recognition of the non-government controlled areas of Donetsk and Luhansk oblasts in Ukraine as independent entities, and the ensuing decision to send Russian troops into these areas. The scope of the measures is limited to the non-government controlled territories of Donetsk and Luhansk oblasts. These measures include: an import ban on goods restrictions on trade and investment related to certain economic sectors a prohibition on supplying tourism services an export ban on certain goods and technologies Restrictions on economic relations with Crimea and Sevastopol The Council adopted restrictive measures in response to the illegal annexation of Crimea and Sevastopol by the Russian Federation. The measures apply to EU nationals and EU-based companies. Their scope is limited to the territory of Crimea and Sevastopol. These measures include: an import ban on goods restrictions on trade and investment related to certain economic sectors and infrastructure projects a prohibition on supplying tourism services an export ban on certain goods and technologies On 21 June 2021, the Council extended these measures until 23 June 2022. Economic sanctions targeting exchanges with Russia in specific economic sectors In July and September 2014, the EU imposed economic sanctions targeting exchanges with Russia in specific economic sectors. In March 2015, EU leaders decided to align the existing sanctions regime to the complete implementation of the Minsk agreements, which was scheduled for the end of December 2015. Since this did not happen, the Council extended the economic sanctions until 31 July 2016. The economic sanctions have been extended successively for six months at a time since 1 July 2016. The decision to extend them was made each time following an assessment of the implementation of the Minsk agreements. The economic sanctions are currently extended until 31 July 2022. These restrictive measures: limit access to EU primary and secondary capital markets for certain Russian banks and companies impose an export and import ban on trade in arms establish an export ban on dual-use goods for military use or military end users in Russia curtail Russian access to certain sensitive technologies and services that can be used for oil production and exploration On 23 February 2022, the Council decided to introduce a sectoral prohibition on financing the Russian Federation, its government and Central Bank. By restricting the ability of the Russian state and government to access the EU’s capital and financial markets and services, the EU aims to limit the financing of escalatory and aggressive policies. Measures concerning economic cooperation Restrictions on economic cooperation were introduced by EU leaders in July 2014: the European Investment Bank (EIB) was requested to suspend the signing of new financing operations in the Russian Federation EU member states agreed to coordinate their positions within the European Bank for Reconstruction and Development (EBRD) Board of Directors with a view to also suspending the financing of new operations the implementation of EU bilateral and regional cooperation programmes with Russia was re-assessed and certain programmes suspended.

- Seven Top Tips for International Export and Import I wish I had known sooner

As your personal customs manager and worldwide trade professional, it is critical that I share these helpful hints with you; I wish I had known them sooner. It would have saved me a lot of time and aggravation. But, if it's too late for me, it can't be too late for you:-) Here's a quick rundown of my top recommendations Here is a handy summary of my top tips Accurate paperwork reduces the likelihood of complications and delays. Ensure that your company and the client have a written contract in place that outlines where the things will be delivered and who will be liable for each stage of the trip. You'll need paperwork for the product's shipping as well as travel insurance. Proper paperwork may be an important factor in receiving payment. Take into account the demands of both the country from which the commodities are exported and the country into which they are imported. Cooperate and, if required, seek support. You might wish to seek assistance with documentation. A freight forwarder is a service that many businesses utilise. Are you sure of your total landed cost? Takeaway: Apply these tips to lessen the danger of border delays and costly compliance concerns. To discuss how book a free videocall. Tip 1: Accurate commercial paperwork minimizes the risk of problems and delays Correct documentation decreases the possibility of issues and delays. Many business owners make the most common mistake of neglecting to maintain all of their documents in order. Is all of your information in one place? Have you filled in all the blanks correctly and completely? The lender may reject your application if any portions are missing. It will be delayed even if it is not rejected. So, double-check that everything is in order before submitting any paperwork. This includes any tax documentation and permissions that the bank or lender may require, as well as all of your financial records, so that they may cross-reference them with their own databases. Check that all the information you give is correct. If you would like, we can do this for you, too. Just get in touch and drop a message in the chat. Tip 2: You're Only As Good As Your Contracts, Draft Them Right Make sure your organisation and the customer have a formal contract that specifies where the items will be delivered and who will be responsible for each stage of the journey. As an export and import specialist, it is your responsibility to guarantee that things are delivered to your global consumers or that the commodities you bought arrive on time. This is easier said than done because a number of things may go wrong along the way. If you do not have sufficient terms and conditions in place with your customers and suppliers, your business may suffer. Additionally, ensure that your organisation and the customer have a formal contract in place that specifies where the items will be delivered and who will be responsible for each point of the journey. The contract must be clear and clarify who would pay for any additional storage or shipping costs that may arise. Tip 3: Think about the “other” paperwork: Transportation, Insurance and Customs Documents You'll need documents for the products' transportation, as well as insurance for the travel. A classic document is the CMR road transport documentation. If you are interested to learn on how to complete the top eight export documents, please see our blog here. During the transport, you need to consider if there are any restrictions on the items' movement. Import or export licences may be required. For example, some goods may be prohibited from crossing certain borders. lf so, many products are subject to specific requirements and regulations related to their transportation and storage. Meeting these regulations will require proper planning and preparation. We can help with that. Tip 4: Think About Getting Paid Early On: When and How. Documents are also required in order to get paid. Make certain that they are in place in international trading. Getting paid overseas is not the same as getting paid at home. You must be able to offer the necessary documentation to establish exactly what you sold in order to get reimbursed for it. For customers from other countries, the issue of fraud and counterfeit goods is a genuine worry. So, while selling internationally, don't expect to get paid based on your delivery date or the day your goods were transported overseas. Instead, remember that payment will be contingent on your ability to produce the necessary documentation on time. Documents are also required in order to get paid. Ensure that they are all in place for foreign trading. Tip 5: Import Your Products Safely and Avoid Potential Losses Due to Customs Consider both the needs of the country from which the commodities are exported and the needs of the country into which they are imported. Cooperate and, if required, seek support. Many particular restrictions control the import and export of various items, and they range from nation to country. You must ensure that you completely grasp the legislation in effect in each nation, or you risk getting into serious problems. Some items, such as agricultural commodities and foodstuffs, are subject to limitations. Certain things, however, are prohibited from being exported or imported under any circumstances. Antiques, endangered animal species, guns, and drugs are among them. It is critical that you know what you are capable of shipping before you do so. We have a dedicated section on export controls on our expert blog as well as on the import requirements for food. There is also dedicated customs training on worry-free export and import controls that you can book here. Tip 6: Use The Right Freight Forwarder You might wish to seek assistance with paperwork. A freight forwarder is a service that many businesses utilise. Look for a freight forwarder who has handled similar imports in the past. A professional freight forwarder will be able to answer your queries and handle the majority of the paperwork for you. The freight forwarder's role is to coordinate the transportation of products between two sites. This includes the following reserving cargo space on ships, planes, or other modes of transportation ensuring that cargo arrives at the correct location, at the appropriate time, and at the lowest possible cost dealing with customs clearance. You may need to issue clear instructions. We have created a dedicated customs broker management course that you may wish to study. delivering additional specialised services a variety of financial services, such as loss or damage insurance A good freight forwarder may be the difference between successful and failed international trade. A freight forwarder's primary responsibility is to coordinate the transportation of your cargo, but they often offer other services such as customs clearance, insurance, and tracking. Choosing a reputable freight-forwarding agent might be a daunting endeavour if you're new to international shipping, or even if you're not. There are various differences in service and pricing, so it's crucial to know what to look for when deciding on a good one. Contact us to discuss how we can help you find a good one. Read: How to avoid delays, stop duty payments, and fix incorrect customs declarations from the start No more snafus! There will be no extraneous duties! There will be no more wrongly filled Customs Declarations. We'll explain how! Tip 7: Consider The Costs Besides The Price Tag What does it cost to buy from a foreign country? You must examine the entire landing expenses before making a selection. If the only essential aspect was the price offered per unit, it would not be necessary to evaluate the other factors that might affect the total landed cost. However, any smart logistics manager will tell you that there is more to consider than the sticker price. Importing from another nation is not as straightforward as purchasing a product and having it delivered to your doorstep. Shippers face challenges due to probable delays, greater freight expenses, and the possibility of damage or loss during the long voyage overseas. Duties, taxes, demurrage adjustments, municipal taxes, clearing charges, and other fees must also be considered. Takeaway Shipping items internationally can be a daunting task, not just because of the distance involved but also due to the difficulty in working with individual governments and trying to communicate what needs to be done, when and by whom. It's important to know all the steps you need to take and all the documents required, as well as make sure that you get all of them right. These seven tips are the first step to help you export and import internationally with success. Are You Up To Date? Your job, on the other hand, requires you to be up to date on any changes in customs and export legislation. As your dedicated Customs Manager, I will also keep you up to date on current developments that are relevant to your everyday issues, as well as upcoming opportunities and hazards, through our regular professional blog information service. When you read professional blogs, you will get Recommendations for action in the context of import & export transaction processing Avoiding import & export mistakes: protection against financial fines or losses Make the most use of all customs and preferential procedures to save money. Instructions and templates for working with systems and documents in a step-by-step manner Exemplifications from import and export practice make it simple for you to apply what you've learned to your position and duties right away. Tips and strategies for securing your company's finances Then go ahead and request immediate access to the whole expert blog, with all barriers removed. presently. Try it out for free for 30 days. We compile the most recent and important information for you and provide it to you in a practical and beneficial, brief and transparent manner. From now on, you will no longer be left alone: A FREE 30-day trial to our expert blog A FREE Try of our "Get a Customs Manager" service" A FREE practical guide "The 8 most important forms for your export business" These highlights are waiting for you with a no-commitment 30 days trial: 15+ customs and global trade topics covered You get access to a wide range of topics under my competent supervision. Customs and global trade are more than just a set of procedures. It is all about putting in place compliant and effective processes to deal with your company's most critical logistical, financial, and reputational risks. We keep you up to date on global compliance, customs laws, duty rates, global trade programmes, import/export, and much more through our professional blog. You request - we write We are always pleased to write about themes that are important to you, and your recommendations may easily be included in our work. In fact, some of the most popular entries on our blog were created just for clients, such as "How to reimport repaired items overseas without paying customs charge." We also have dozens of blog entries in the works that need to be written. We try our best to prioritise these depending on their importance to our clients' enterprises. As our partner, please submit an issue that is important to you. E-mail info@customsmanager.org or write us in the chat. You ask - we answer! How often do you feel intensely and as if blocked in front of a purportedly large obstacle, and time is of the essence? − You can't always know everything, but at the very least, you know who can. Of course, I am your dedicated Customs Manager! Simply give me your query by e-mail or chat, and as subscribers of our paid plan, we will respond as soon as possible. Sounds good? − Try it out risk-free!

- The 8 most crucial forms for your export business - practical recommendations for filling them out

What trade documents, including transport and payments paperwork, are essential to ensure import and export success? We identify what businesses need now Trade documentation It’s wise to seek advice on this if you’re unsure. Your local Chamber of Commerce should be able to advise you on what you’ll need, and you can also ask your customer. There are some common types of international trade documentation which you may need to export: Certificate of origin This states where a product was produced, manufactured or processed. It may be required for customs clearance in your destination market. Your Chamber of Commerce can issue these. Commercial invoice This provides information for the customs authorities, which helps them asses if the goods can move in or out of a country and what, if any, controls are needed. It also helps them determine duties and taxes. Every shipment must have its own commercial invoice. Packing list A packing list is the only way in which a consignment can be cleared for entry into a new market and most importantly the only way in which the border crossing or customs officer can tell what is supposed to be in each carton being delivered overseas. Export licence There are special requirements for some controlled goods, such as firearms, medicines, plants and animal products - a licence may be required. Local regulations If you are exporting, you should check whether any special documentation is required overseas to satisfy local regulations. For example, you might need documentary proof that your goods meet local product standards. Dangerous goods Dangerous goods must be accompanied by appropriate special paperwork. Insurance You may need to insure the goods, and you may also be required to provide proof of insurance to your customer, particularly if you are passing on the costs. You should discuss what documentation is required with your customer and your insurer. Transport documentation Transport documentation is needed to provide instructions to the carrier on what should be done with the goods. It is also used to define responsibility for, and sometimes ownership of, the goods during their journey. Common types of international transport documentation include: Export cargo shipping instruction An export cargo shipping instruction gives the freight forwarder details of the goods and how they are to reach their destination. Standard shipping note This contains information about your goods and the companies involved in sending, shipping and receiving them. You must use a standard shipping note if you’re shipping goods overseas. Bill of lading or a waybill A Bill of Lading (sea transport) or a waybill (air transport) act as documentary evidence that your carrier has received the goods. You should keep these as evidence in case there are any later problems with the shipment. CIM consignment note A CIM consignment note gives details of the goods being transported. Proof of insurance You may need to insure the goods, and you may also be required to provide proof of insurance to your customer, particularly if you are passing on the costs. You should discuss what documentation is required with your customer and your insurer. Payments documentation The right paperwork plays an important part in making and receiving payment. It reduces the risks of the customer failing to pay, or the supplier failing to deliver. Common types of payment documents you should consider include: Bank collection or documentary collections (D/C) When using the documentary collection, the exporter prepares a bill of exchange stating how much is to be paid and when. The exporter’s bank issues instructions to the buyer’s bank for release of the documents against either payment (documents against payment) or acceptance of a bill of exchange (documents against acceptance). In the latter, the buyer agrees to make payment at a certain future date. A documentary collection is used primarily for shipments by sea. Letter of credit, also known as a documentary credit A letter of credit (L/C) is a guarantee from a bank on behalf of the buyer. The buyer’s bank agrees to pay the exporter once all the right documentation - such as transport documents showing the right goods have been despatched - is received. The exporter must provide the required paperwork within the agreed time limit and with no discrepancies. If you are using one of these payment methods, it’s important to understand what documentation is required and ensure it is accurate. Payments under letter of credit can be particularly problematic, as the exporter must provide exactly the right documentation to get paid. Regardless of what payment method you agree with, you should have a clear written contract stating what amount is due, in what currency, and when. The contract should also make it clear who is responsible for any bank charges and who is responsible for goods throughout the export process. See our guide on Incoterms in international trade contracts. For more details, please contact your dedicated Customs Manager.

- How to avoid delays, stop duty payments, and fix incorrect customs declarations from the start

No more snafus! There will be no extraneous duties! There will be no more wrongly filled Customs Declarations. We'll explain how! Houston, we've got a problem… Let's face it, you realize it, too, don't you? Your customs broker is not up to the task. They are unable to get their goods through customs as quickly as you require, and they are unable to respond to any of your queries efficiently and quickly. They seemly can't figure out why they're having so much trouble getting their items through customs. There is turmoil in paradise...and you, as the person in charge of managing your brokers and clearing items through customs, must intervene. But how exactly? How can you assist them if they don't appear to recognise themselves? The consequences are disastrous for you business, and they appear to be getting worse... Shipments are being held up. You're facing hefty duties and can't seem to bring them down; You're not sure whether your customs declarations are being done correctly, You get the impression that your customs broker is just not up to the task. You have difficulty comprehending them since they frequently talk in riddles. They are failing to follow out your commands. We need an intervention here and fast. Now you can effectively instruct your Customs Broker - With Our High-Impact Online Training Course to Reduce transportation delays Lower your duty expenditure to nil Comply with the standards for customs declaration completion Excel at the next customs audit Manage your brokers well so that they don't require any assistance Save time by focusing on more significant activities Customs Agents Are Vital For Your Global Trade Growth Customs Agents or Representatives are required for global enterprises to enter or exit a country. Choosing the proper ones and communicating with them about how you want products cleared is critical for global expansion. Here is what you walk away with Our training gives you practical information and the finest guidance on how to properly teach your customs agent how to follow instructions and assess their efficacy. There will be 5 training units to be studied online - providing maximum flexibility to study whenever and wherever. Students can ask questions anytime using the chat function or e-mailing their tutor directly. This is followed by a LIVE session with your trainer. Here is an overview of the 5 online parts that you will study PART 1: What is a customs agent? Direct vs. Indirect Explained. Explore what they can and cannot do for you. Customs brokers, in the end, operate as the facilitators of your shipments and are therefore heavily involved in the processing of your import cargo. Their primary responsibilities include those of a middleman, ensuring that the government provides everything required for you to properly import and export items in a safe and efficient manner. What is the proper legal standing required to engage with them? Learn what they are and are not capable of doing for you. PART 2: Learn about the relevant evaluation criteria for a business when choosing a broker that suits your business Any business that imports/exports goods require a broker to facilitate and expedite the process. Selecting one can be tricky, however. There are numerous players in the market who promise seemingly great services, but they might not deliver. The customs broker management course below explains exactly what you need to look out for and how to decide on an ideal broker partner. PART 3: Provide your broker with the right document for accelerated customs clearance In this part, we will look at the types of papers that may be required to provide the necessary instructions to brokers. We will show how this paperwork enables the proper completion of the customs declaration. We examine numerous documents in further depth. PART 4: Learn what information your agent needs and issue effective instructions In this part, we'll look at how to supply your broker with the necessary documents for expedited customs clearance. Are you prepared to examine and analyse the documentation required for customs clearance, as well as the critical data pieces that your broker may not always locate in the paperwork? In our second section, we'll look at other techniques for you to teach agents, such as e-mails, phone conversations, and checklists. We looked at more formal SOPs as well as how and why KPIs are created. Don't overlook the annexes, which provide examples, models, checklists, and basic construction components. PART 5: Top tips to build long-lasting and effective work relationships with your customs agent + EXAM Relationships of any kind, whether they be interpersonal or business-related, involve trust. And to have a successful, long-lasting relationship that builds trust takes effort on both the client's and agent's part. To begin the process of building trust with a particular customs broker, we explore simple things you can do. Of course, there will be an "exam" at the conclusion, as well as a certificate of completion for those students who complete the course. Next, meet LIVE! Then meet your trainer LIVE! in a session where you can ask inquiries clarify the study's findings go deeply into any difficulties or questions apply what you've learned to your organisation with our help. create a road plan of tasks to be taken discuss difficult problems. You will benefit from your skilled trainer's undivided attention as he or she assists you in understanding, clarifying, and planning the next actions. Book your training now by sending us a quick message on the Chat on www.customsmanager.org or e-mail info@customsmanager.org Pass EXAM to receive your Certificate of Completion Of course, there will be a "exam" at the end of the course, as well as a certificate of completion for those who finish it. How will the training be delivered? Forget about reading dull texts. Our course is jam-packed with videos, graphics, and visual aids to help you learn, as well as checklists and downloads that you can use right away in your day-to-day life. In addition, we hear directly from brokers in unique video interviews. Book now Let's speed up your shipment and set up a broker management system - the right way. Book your training immediately by leaving us a fast message on www.customsmanager.org 's Chat or by emailing info@customsmanager.org . Not quite ready yet? No problem, find out more about the need for customs broker management first. The teacher of this course, has written an excellent expert blog on the subject which is free to read: EXPERT BLOG: Need to appoint a customs broker, agent, or representative? What to think about.... Selecting the right partner to manage your imports and exports is crucial for trade success. There are some essential points to consider, argues Arne Mielken from Customs Manager Ltd. Read the blog There is more you can do.... At Arm's Length, Please: Subscribe to the Free Newsletter No commitment, no need for details apart from your email address. Let's start off slowly, step by step. Get interesting news on customs & global trade delivered to your inbox. Visit www.customsmanager.org Get a little closer: Become a free Member and Get a Customs Manager Interested in getting ongoing support by a real Customs Manager for no cost, full of practical tips and tricks on how to make your life easier. Become a free, no commitment member of Customs Manager and get a real global trade professional allocated to you. Just register an account with www.customsmanager.org -> Log In at the top right corner and select "New to this site? Sign Up"

- Russia Sanctions: What Every Global Trade Professional Should Know

A presentation of the legal obligations imposed by the UK Sanctions Rules and Regulations, including a webinar hosted by the Sanctions authorities. Introduction The United Kingdom has imposed sanctions against Russian firms and individuals because of the country’s involvement in an ex-spy’s poisoning, the occupation of Crimea and its involvement in the military conflict in Ukraine, to name but a few. In 2022, there has been a wide range of rounds of measures, including freezing the assets of Russians, most of whom are government officials, as well as Russian companies and two other firms based elsewhere but which have ties to Russia. This post will discuss UK legal analysis on Russian sanctions, along with associated information that may be useful to Customs and Global Trade professionals. It is expected that additional sanctions against Russia will occur over time; therefore, legal information related to current sanctions should be used as a starting point when planning future operations involving imports or exports of goods from or into Russia. Key Facts The UK imposes a wide range of sanctions against Russia, certain Russian entities and organisations. Businesses must ensure they do not trade with sanctioned individuals or entities or organisations. The UK has been instrumental in drafting EU sanctions against Russia following its annexation of Crimea. Since Brexit, the UK has drafted its own sanctions law. In addition to provisions aimed at restricting trade with Crimea, these sanctions target individuals and entities involved in violating Ukraine’s territorial integrity and sovereignty or who are contributing to instability in Ukraine. These measures also restrict new arms sales to Russia. Summary of UK Sanction's Regulations against Russia You should also review the following regulations to find out any changes made to the Regulations: the Sanctions (EU Exit) (Miscellaneous Amendments) (No. 2) Regulations 2020 the Sanctions (EU Exit) (Miscellaneous Amendments) (No. 4) Regulations 2020 the Russia (Sanctions) (EU Exit) (Amendment) Regulations 2022 the Russia (Sanctions) (EU Exit) (Amendment) (No. 2) Regulations 2022 the Russia (Sanctions) (EU Exit) (Amendment) (No. 3) Regulations 2022 the Russia (Sanctions) (EU Exit) (Amendment) (No. 4) Regulations 2022 the Russia (Sanctions) (EU Exit) (Amendment) (No. 5) Regulations 2022 the Russia (Sanctions) (EU Exit) (Amendment) (No. 6) Regulations 2022 the Russia (Sanctions) (EU Exit) (Amendment) (No. 7) Regulations 2022 the Russia (Sanctions) (EU Exit) (Amendment) (No. 8) Regulations 2022 See here for direct access: https://www.gov.uk/government/collections/uk-sanctions-on-russia The first 2022 amendment sought to broaden the "Designation criterion" and include more meanings. The Second Amendment focuses on financial constraints. Main elements of the Russia (Sanctions) (EU Exit) (Amendment) (No. 3) Regulations 2022. The sanctions comprise a list of critical-industry products and technology that are currently prohibited from export, supply, transfer, or use in Russia, as well as the provision of related technical assistance, financial services, and brokering services. Existing limitations on the export, supply, or transfer of military and dual-use equipment, as well as on the export or supply of energy-related goods and services, remain in force. There are several exceptions to these limitations, which are detailed in the statute, and licences can only be given in extremely specific circumstances. The full details of the new measures, which augment the sanctions measures introduced in 2014, can be found in Russia (Sanctions) (EU Exit) (Amendment) (No. 3) Regulations 2022. Main elements of the Russia (Sanctions) (EU Exit) (Amendment) (No. 4) Regulations 2022. Amendment No. 4 examines shipping sanctions. Main elements of the Russia (Sanctions) (EU Exit) (Amendment) (No. 5) Regulations 2022. Amendment No. 5 examines financial and investment constraints. Main elements of the Russia (Sanctions) (EU Exit) (Amendment) (No. 6) Regulations 2022. Amendment No. 6 addresses new aviation and trade restrictions. Webinar delivered on 17.03.2022 delivered by Gov.UK Return to a webinar to learn more about the scope of UK sanctions and financial restrictions: Those who watch this will hear from the following government departments on these topics: Measures Task Force and the Foreign Commonwealth and Development Office have agreed on the scope of the sanctions. ECJU financial Sanctions: limits and general licences - HM Treasury Office of Financial Sanctions Implementation (OFSI) Export Support Service Ukraine / Russia - Department for International Trade trade sanctions enforcement - HM Revenue and Customs Main elements of the Russia (Sanctions) (EU Exit) (Amendment) (No. 7) Regulations 2022. The Regulations expand the current Crimean banking, maritime, and trade restrictions to the non-government held territories of Ukraine's Donetsk and Luhansk oblasts. The necessary exclusions and licencing rules are also extended to the non-government controlled territories of the Donetsk and Luhansk oblasts by the Regulations. The exception's cut-off date remains December 20, 2014, for contracts relating to Crimea, and February 23, 2022, for contracts relating to non-government-controlled territories of the Donetsk and Luhansk oblasts. According to the law, designated people are those who fit a specific description. Persons identified by description, like those designated by name, may be barred from entering the United Kingdom and subject to financial restrictions, such as having their cash or economic resources blocked, or to shipping or aircraft sanctions. The Regulations forbid the giving of technical assistance pertaining to aeroplanes and ships to or for the benefit of a specified person. This includes the authority to designate individuals for the purposes of such penalty, as well as related exclusions and licencing rules. The Regulations also make changes to allow a licence to be issued to allow the movement of aircraft that would otherwise be prohibited; to suspend rather than simply revoke permission; third, to ensure the exception for acts done for the purposes of national security or the prevention of serious crime applies to prohibitions in and under the rules for aircraft, too; and fourth, to amend the penalties for offences) to ensure that each offence for ships is covered. Presentation by Customs Manager on the Russian Sanctions (12.04.2022) Returning to a basic presentation on Russian sanctions given to ACITA on April 12, 2022. This is the voice of international commerce in the United Kingdom, serving as a focal point and platform for traders and consultants active in cross-border trading. Download it here. Main elements of the Russia (Sanctions) (EU Exit) (Amendment) (No. 8) Regulations 2022. New trade restrictions are introduced in connection to equipment and technology for oil refining (as specified in new Schedule 2D), quantum computing, as well as sophisticated materials and technologies (as specified in new Schedule 2E), luxury items (as defined under the new Schedule 3A), and items made of iron and steel (as specified in new Schedule 3B). The items mentioned in new Schedules 2D, 3A, and 3B are identified by reference to commodity codes found in the United Kingdom Tariff. By amending Part 7 of the 2019 Regulations, Regulations 5, 6, and 7 allow for licensure and exemptions from the new requirements. Regulations 8 and 9 provide adjustments to the enforcement provisions in Parts 9 and 10 of the 2019 Regulations. Please visit: https://www.legislation.gov.uk/uksi/2022/452/note/made Access the Schedule: https://www.legislation.gov.uk/uksi/2022/452/schedule/made More about "Designations" - What are they and how do they work The UK may designate those who are or have been active in destabilising Ukraine, as well as undermining or endangering Ukraine's territorial integrity, sovereignty, or independence. Designated individuals may be barred from entering the United Kingdom and subject to financial sanctions, including having their cash or economic resources frozen. Since the invasion of Russia into Ukraine in 2022, the UK has sanctioned more than 300 of Russia's most prominent and high-value persons, businesses, and subsidiaries, with over 500 of them being included in the UK's sanctions list. For example, in the context of the Russian war against Ukraine, this includes members of the Russian Duma and Federation Council who voted to recognise the independence of Donetsk and Luhansk in flagrant violation of Ukraine’s territorial sovereignty. Examples of prominent UK sanctioned persons include Roman Abramovich is the owner of Chelsea Football Club and holds investments in steel companies Evraz and Norilsk Nickel. En+ Group is owned by nickel tycoon Oleg Deripaska. Rosneft's Chief Executive Officer is Igor Sechin. VTB bank's Chairman is Andrey Kostin. Alexei Miller is the CEO of the Russian energy firm Gazprom. Transneft, Russia's state-owned pipeline enterprise, is led by Nikolai Tokarev. Bank Rossiya's Chairman of the Board of Directors is Dmitri Lebedev. Gennady Timchenko, Russia’s sixth-richest oligarch Boris and Igor Rotenberg, 2 long-standing associates of the regime. For the list of designated persons, please see here: https://www.gov.uk/government/publications/the-uk-sanctions-list The UK has been at the forefront of this effort, shutting out large proportions of whole sectors of the Russian economy, such as its defence industry, its financial institutions and its transport sector. What do I need to know about Asset Freezes? An asset freeze prohibits any UK citizen or business in the UK from engaging with any funds or economic resources owned, possessed, or controlled by the designated person and kept in the UK. It will also prohibit finances or economic resources from being supplied to or for the advantage of the designated individual. This means that if you are holding money or stock from a designated person, you cannot return it to the owner. For example, in the Russian war against Ukraine in 2022, the assets of 5 Russian banks involved in bankrolling the Russian occupation were frozen. This includes Bank Rossiya, which is particularly close to the Kremlin, Black Sea Bank for Development and Reconstruction, IS Bank and Genbank. The assets of Promsvyazbank, the pivotal bank in propping up Russia’s defence sector, have also been frozen. There is more guidance on Asset Freezes and what to do here: https://www.customsmanager.org/post/guidance-on-asset-freezes Travel bans UK Sanctions usually include a travel ban. This means that the designated person must be refused leave to enter or to remain in the United Kingdom, providing the individual to be an excluded person under section 8B of the Immigration Act 1971. Transport Bans It can be a criminal offence for any Russian aircraft to fly or land in the United Kingdom, and the government has the authority to remove aircraft belonging to specified Russian persons and businesses from the UK aircraft registry, even if the sanctioned individual is not on board. Russian ships are also barred from entering UK ports. In fact, the current Regulations also give specified maritime enforcement officials the authority to stop and search ships in international and foreign waters for the purpose of implementing specified trade restrictions and seizing items discovered on board ships that are being or have been dealt with in violation. Restrictions on dealings with Crimea These Regulations impose restrictions on trading in military equipment and technologies, on a limited number of dual-use and energy-related devices, delivering items and technologies associated with infrastructure supply of services associated with the commerce in certain commodities individuals from dealing with specific financial products, the availability of financing and capital, as well as the restriction of investment in Crimea The Regulations provide for certain exceptions to this sanctions regime, including in relation to financial sanctions (for example to allow for frozen accounts to be credited with interest or other earnings), trade sanctions and also acts done for the purpose of national security or the prevention of serious crime. Extension of Crimea Sanctions to Donetsk and Luhansk The territorial sanctions imposed on Crimea to non-government-controlled territory in the so-called breakaway republics of Donetsk and Luhansk. No UK individual or business will be able to deal with this territory until it is returned to Ukrainian control. Licences for Import and Export The UK government can provide licences for actions that would otherwise be forbidden under the enforced financial and trade restrictions. The purposes for which such permits shall be issued by the Treasury are specified in Schedule 5 of these Regulations. Criminal Infraction The Regulations make it a criminal offence to violate or bypass any of the restrictions in these Regulations, and they specify the form of trial and punishment for such offences. Documents The Russia (Sanctions) (EU Exit) Regulations 2019 An explanatory memorandum accompanies the regulations, providing further information on their provisions. Source https://www.gov.uk/government/news/abramovich-and-deripaska-among-seven-oligarchs-targeted-in-estimated-15bn-sanction-hit

- What You Should Know About Importing Composite Foodstuffs Into The EU

Some pigs will fly before you can import certain foods into the EU. Let's explore the rules. Composite goods are commodities that comprise both plant-based and animal-based processing ingredients. For these products, you may need export health certifications to get into the EU. In this blog, you can find a guide, a decision tree, timeframes, requirements, and exemptions. Let's go! When goods containing animal and plant products enter the EU, they are subject to extra paperwork controls and veterinary tests. What are composite products? Composite food and beverage items are made up of a combination of plant and processed animal components. Lasagne, ham pizza, and cream liqueurs are among examples. Many of these items coming into the EU from other countries are subject to inspection to ensure they fulfil EU food safety regulations. The danger caused by composite goods to human and animal health is determined by the type of components used, as well as the storage and packing circumstances. However, there are few exceptions, most notably where the public health risk is deemed to be small. The EU has created a list of such items that are excluded from these inspections. What are the EU rules and requirements on composite products? Requirements will no longer be dependent on the amount of meat, milk, and other animal-derived components in processed food preparations. This indicates that the percentage of animal-derived processed products in the composite product is unimportant. Instead, they will be determined by the animal or public health risk associated with certain animal-derived products, as well as the manner in which they are transported or kept. If this occurs at a regulated temperature, these are now referred to as "non-shelf-stable" composite items. They are said to as "shelf-stable" if they can be stored at room temperature. EHC Third-country firms fulfil these standards by submitting an export health certificate (EHC). This is a formal document confirming that the export fulfils the EU's health regulations. If a company transports food manufactured from animal products from a third nation to the EU, it must normally apply for an EHC. This means that if a shelf-stable product has no processed meat, it is immediately lower in danger. Exemptions Certain sweets, chocolate, pasta, bread, cakes, biscuits, waffles, and soups may be excluded from official restrictions at the EU's border checkpoints. However, in order for this to happen, the food must be manufactured in EU factories or situated in other countries but authorised for import into the EU. At the moment, all food outlets in the United Kingdom are certified for EU imports. What challenges do they pose for food manufacturers? The new legislation means that new EHCs have been introduced and some existing EU EHCs will be replaced. Unless, of course, they are exempted. Knowing whether they need an EHC, selecting the right and most up to date one, completing and certifying it correctly confuses many businesses. Yet, much depends on getting this right. Third country food exporters need to use the correct new export health certificate (EHC) to ensure not being stopped at the border and potentially turned around or the food destroyed. So, make sure you get this right, if you are an exporter of composite products you will need to use the new certificate. How can food manufacturers navigate the changes, and what advice would you give them? Step 1 Identify which of the categories your product falls: Shelf-stable or no shelf-stable. Step 2. Check if meat or meat products are present. Step 3. Check if you could be exempt from an EHC. If you are exempted, remember to still follow the traditional export rules and consider providing the driver with some evidence. Step 4 Identify the right EHC. You can find the new and old set of certificates here: https://www.gov.uk/export-health-certificates?keywords=composite+product Step 5 Ensure it is completed correctly and properly certified by a veterinarian Step 6 Before shipment, ensure the movement is registered in the EU Commission’s Trade Control and Expert System (TRACES). Step 7 Ensure the transport operator exporting the goods out of the UK has the complete and correct paperwork when arriving at the UK border. What other documentation is required for composite products that are exempt from certification? Make sure you don’t forget that you still need to follow the traditional export formalities, too. So, besides your export health licence, you must file an accurate customs' declaration, issue the correct invoice for international trade, ideally with a statement of origin (to claim preferential duty), have the right packing list alongside transportation documentation, e.g. a CIM consignment note. You may need to provide proof of insurance, too. Summary of changes Download the decision-making tree Download the graph comparing April and October 2021 changes Overview of requirements FAQ