top of page

Search For The Content You Need

Browse our articles to see if we cover the topics you are interested in, when you found it, upgrade to a paid plan for full, unrestricted access to all premium resources.

Best Practice: Customs Tariff Clauses in Contracts

Customs Tariffs can shake up your global trade. We propose best practices on how to amend your cross-border contracts, including sample language.

Arne Mielken

6 min read

U.S. Tariffs Hit Penguins? 5 Bizarre Places Affected

President Trump’s 90-day tariff pause has left businesses and consumers wondering what comes next. Here’s what you need to know.

Arne Mielken

4 min read

U.S.: Valuing Gift, Samples & Demo Equipment

Don’t guess the value of gifts, samples or demo goods! Learn how to stay compliant with customs rules for these tricky shipments and study our case study.

Arne Mielken

6 min read

U.S.: Valuing Used Goods After Repair

Discover how to value repaired goods returning to the U.S. without a sale, using depreciation and fallback methods.

Arne Mielken

4 min read

Defer Duty, Not Progress

Setting up a deferment account is crucial for smooth importing, argues Arne Mielken, Customs Advisor of Customs manager Ltd.

Arne Mielken

6 min read

U.S. - China Trade War explained: 34%- 84%- 125%

Washington delivers a tariff gut punch: U.S. hikes reciprocal duties on Chinese goods from 34% to 84% to 125% —as China retaliates - here’s

Arne Mielken

13 min read

U.S. Alu & Steel Duties: EU Countertariffs from 15 April 25

The EU's strategic response to US tariffs includes targeted countermeasures. Discover which products are impacted and access VIP downloads

Arne Mielken

6 min read

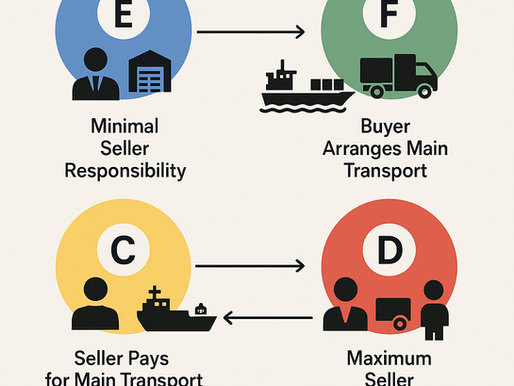

Incoterms & Customs: Know the Rules

The right Incoterm can make or break your customs compliance strategy.

Arne Mielken

4 min read

The Big Lie: US 'Reciprocal' Tariff Rates

The U.S. reciprocal tariff calculations misinterpret rates, merely spotlighting the trade deficit rather than actual tariffs.

Arne Mielken

5 min read

Reciprocal Tariffs: Guidance on Country Specific Duties

New U.S. import duties kick in on April 9, 2025. Learn who’s affected, what’s changing, and how to stay compliant.

Arne Mielken

5 min read

Reciprocal Tariffs: CBP Guidance (CSMS)

The U.S. has introducing a 10% reciprocal tariff since April 5, 2025. Here’s what importers need to know to stay compliant.

Arne Mielken

3 min read

Customs Classification: Samsung's $601 Million Fine

Latest Updates of UK Guidance and Policy as regards customs. All in one page

Arne Mielken

3 min read

Customs Value: Insurance Costs

Learn how to calculate insurance costs for customs valuation and understand what can and cannot be included.

Arne Mielken

4 min read

Customs Value: Delivery Costs

Are you clear on which delivery costs must be included in customs valuation? Discover which costs are essential for compliance and avoid cos

Arne Mielken

5 min read

USA: 10 Ways to Manage Customs Duty Costs

Managing customs duty is key to reducing costs and ensuring compliance. Here are 10 actionable tips to streamline your process.

Arne Mielken

6 min read

U.S. Customs Audits: What to Expect

Understanding U.S. Customs audits is crucial for importers to maintain compliance and avoid penalties. Here's what you need to know.

Arne Mielken

9 min read

US: Overpaying on Steel & Aluminum Tariffs?

Steel and aluminum tariffs could be eating into your profits. Learn how to reduce these costs and optimize your trade compliance strategy.

Arne Mielken

5 min read

Due Diligence Under the EUDR

Navigating Due Diligence Under the EUDR: Your Comprehensive Guide

Arne Mielken

3 min read

EUDR: Space Drives Deforestation-Free Trade

We examine how businesses can utilize free EU Space Tools to promote sustainable, deforestation-free products while minimizing compliance co

Arne Mielken

5 min read

EU's EUDR Implementation

🔍 Learn about the EU's approach to implementing the EUDR, addressing due diligence, IT systems, and compliance challenges.

Arne Mielken

4 min read

bottom of page