Internet Prices for Customs Valuation?

- Madni Laghari

- Jul 28, 2025

- 4 min read

Updated: Jul 29, 2025

Can online prices really determine customs value? A bold CBP ruling just said yes—raising big questions for importers and customs pros. Download the ruling, too.

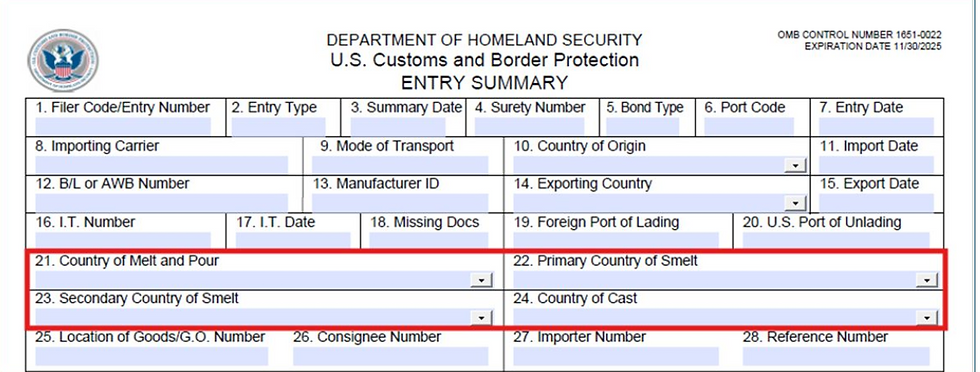

As a Customs Consultant, I've seen many valuation puzzles—but few as eyebrow-raising as a recent ruling. In this case, U.S. Customs and Border Protection (CBP) rejected declared values for imported e-cigarettes and instead turned to internet-listed prices to determine the customs value. We evaluate what this means.

Key Questions Covered in This Blog

Can internet prices replace transaction value under WTO customs valuation rules?

Is using online listings akin to using minimum prices—something the WTO clearly prohibits?

What makes the ruling controversial among Customs professionals?

How does this practice compare with EU customs compliance?

What are the risks for importers, exporters, and trade compliance officers if this sets a precedent?

Abbreviations Used In This Blog

CBP: U.S. Customs and Border Protectio

ACV: Agreement on Customs Valuation (WTO)

HTSUS: Harmonized Tariff Schedule of the United States

CEE: Center of Excellence and Expertise

DIS: Document Image System

“Using online retail prices to appraise customs value is a step back toward valuation practices the WTO tried to leave behind. The Brussels Definition of Value was replaced for a reason.”

Arne Mielken, Managing Director, Customs Manager

Can internet prices replace transaction value?

Want to read more?

Subscribe to customsmanager.info to keep reading this exclusive post.