New U.S. Tariffs for the World

- Arne Mielken

- Aug 1, 2025

- 6 min read

Updated: Aug 4, 2025

The new Executive Order get out new tariffs for the world . Here's what Customs pros must know now.

The White House has just announced sweeping tariff updates under Executive Order 14257, ramping up pressure on trade partners seen as non-reciprocal. Customs professionals in the EU, UK, and USA must act fast to assess the new import risks, compliance requirements, and strategic options.

Arne's Takeaways

|

Key Questions Covered in This Blog

What does the July 31 update to EO 14257 actually change?

How are EU and UK imports affected?

What are the new HTSUS duty calculations for the EU?

Which countries are targeted most?

How does the 40% transshipment penalty work?

What should Customs and Compliance professionals do now?

Abbreviations Used In This Blog

EO: Executive Order

HTSUS: Harmonized Tariff Schedule of the United States

CBP: U.S. Customs and Border Protection

USTR: U.S. Trade Representative

"If you import into the U.S., your costs, risks, and documentation requirements just changed—overnight. You can’t afford to ignore this."Arne Mielken, Managing Director, Customs Manager

Fancy a Call?Book a free expert session to assess how this order impacts your supply chain: www.customsmanager.org → Book Expert Call Get Weekly Game-Changing Updates with The Customs Watch USAStay current on sanctions, trade policy, and customs changes across the U.S. Get alerts you can act on: www.customsmanager.info |

What does the July 31 update to EO 14257 actually change?

This Executive Order significantly modifies tariffs applied to imported goods under the Reciprocal Tariff Regime. It replaces prior rates with updated duty schedules in Annex I and II. Countries are now categorised based on their cooperation with U.S. trade and security objectives. The EO also introduces stricter transshipment controls.

New duties now target 89 countries, including allies like the UK, EU Member States, South Korea, and Japan. Most new duties kick in 7 days after the EO's signing.

How are EU and UK imports affected?

If you import goods from the EU or UK, brace for increased cost and more complexity. Here's how it works:

EU Imports: If the Column 1 duty rate in the HTSUS is under 15%, the U.S. will top it up to exactly 15%. If it's already at or above 15%, there's no added duty.

UK Imports: Hit with a blanket 10% additional duty regardless of product line.

The goal? Pressure these trade partners to close the reciprocity gap—and fast.

What are the new HTSUS duty calculations for the EU?

The U.S applies a variable, product-specific additional duty on imports from the European Union. It's not a blanket tariff. Instead, importers must check each product’s HTSUS duty rate and apply the following formula.

The Rule: Two Scenarios

1. If the current Column 1-General HTSUS duty is less than 15%: Additional Duty = 15% - Column 1 Rate. You must pay enough additional duty to bring the total up to 15%.

Example:

HTSUS duty on an EU-made pump = 2.5%

Additional Duty = 15% - 2.5% = 12.5%

Total duty now = 15%

2. If the Column 1-General HTSUS duty is 15% or higher: Additional Duty = 0%

No change. You just pay the standard rate.

Example:

HTSUS duty on EU-made clothing = 16%

Additional Duty = 0%

Total duty = 16% (unchanged)

Key Impact: Formerly Duty-Free Goods Are Hit Hard

Many EU goods entered the U.S. duty-free under MFN (Most Favoured Nation) treatment — i.e. their HTSUS Column 1 rate was 0%. Now, those goods automatically get a 15% duty slapped on.

Examples of affected products:

Product Category | Typical Old HTSUS Duty | New Effective Duty |

French wine | 0% | 15% |

German machine tools | 0–2.3% | Up to 15% |

Italian chemicals | 0% | 15% |

Spanish olive oil | 0% | 15% |

Dutch semiconductors | 0% | 15% |

What EU Importers Can Do Now

Run HTS code checks for every EU-origin product. Use the HTSUS Column 1-General rate.

Apply the formula:

If <15%, calculate the gap and add it.

If ≥15%, no action needed.

Update landed cost and pricing models. Margins will shrink on affected goods.

Review contracts: Some Incoterms (like DDP) may leave the EU seller liable unless renegotiated.

Compliance Tip

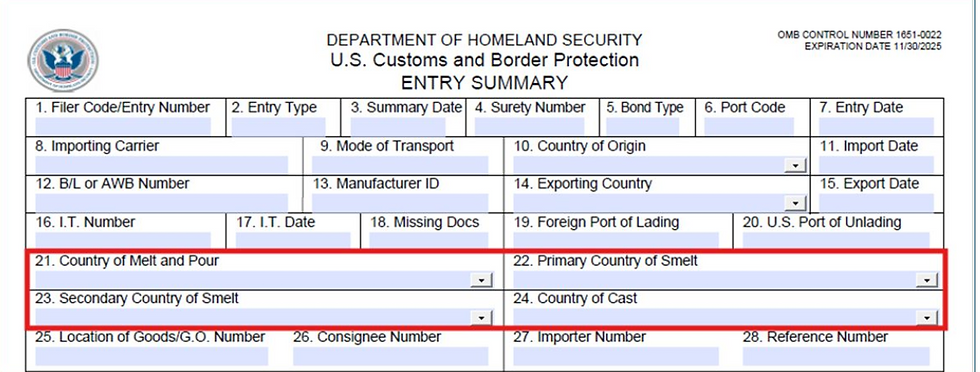

Keep records showing how you calculated the new duty. U.S. Customs (CBP) may review your filings, and misapplying the new rule could trigger penalties under 19 U.S.C. § 1592.

Which tariff rates for which countries ?

The EO applies different reciprocal tariff levels. Here's your table, listing all countries and territories named in Annex I of the July 31, 2025 Executive Order (modifying EO 14257) with their adjusted reciprocal tariff rates, including August updates:

Country or Territory | Adjusted Reciprocal Tariff |

Afghanistan | 15% |

Algeria | 30% |

Angola | 15% |

Bangladesh | 35% (updated from 20%) |

Bolivia | 15% |

Bosnia and Herzegovina | 30% |

Botswana | 15% |

Brazil | 50% (updated from 10%) |

Brunei | 25% |

Cambodia | 36% (updated from 19%) |

Cameroon | 15% |

Chad | 15% |

Costa Rica | 15% |

Côte d'Ivoire | 15% |

Democratic Republic of the Congo | 15% |

Ecuador | 15% |

Equatorial Guinea | 15% |

European Union (EU) | Variable (see note) |

Falkland Islands | 10% |

Fiji | 15% |

Ghana | 15% |

Guyana | 15% |

Iceland | 15% |

India | 25% |

Indonesia | 19% |

Iraq | 35% |

Israel | 15% |

Japan | 15% |

Jordan | 15% |

Kazakhstan | 25% |

Laos | 40% |

Lesotho | 15% |

Libya | 30% |

Liechtenstein | 15% |

Madagascar | 15% |

Malawi | 15% |

Malaysia | 19% |

Mauritius | 15% |

Moldova | 25% |

Mozambique | 15% |

Myanmar (Burma) | 40% |

Namibia | 15% |

Nauru | 15% |

New Zealand | 15% |

Nicaragua | 18% |

Nigeria | 15% |

North Macedonia | 15% |

Norway | 15% |

Pakistan | 19% |

Papua New Guinea | 15% |

Philippines | 19% |

Serbia | 35% |

South Africa | 30% |

South Korea | 15% |

Sri Lanka | 20% |

Switzerland | 39% |

Syria | 41% |

Taiwan | 20% |

Thailand | 19% |

Trinidad and Tobago | 15% |

Tunisia | 25% |

Turkey | 15% |

Uganda | 15% |

United Kingdom | 10% |

Vanuatu | 15% |

Venezuela | 15% |

Vietnam | 20% |

Zambia | 15% |

Zimbabwe | 15% |

Special Note on the European Union:

For EU-origin goods, additional duties apply only when the Column 1-General HTSUS rate is below 15%.

In that case, a top-up is applied to bring the total duty to 15%.

If the HTSUS rate is already 15% or more, no extra duty applies.

Countries on the edge of a trade deal—like Brazil and South Korea—are still penalized until a final agreement is reached.

How does the 40% transshipment penalty work?

If U.S. Customs finds a product was rerouted through another country to skirt these new duties, expect serious consequences:

Extra 40% duty slapped on the goods

No remission or mitigation allowed

Possible 19 U.S.C. §1592 penalties

Every six months, CBP and Commerce will publish lists of suspected transshipment countries and facilities. These will shape procurement, CBP enforcement, and CFIUS reviews.

Expert Recommendation: "Audit your supply chain origin and routing now. Red flags must be eliminated immediately." |

What should Customs and Compliance professionals do now?

Start by mapping your HTSUS codes and flagging any EU- or UK-origin goods under 15%. Those are now tariff risks.

Then:

Update duty calculation models with new rates.

Alert finance, sourcing, and logistics teams.

Prepare to file exclusions or secure updated supplier declarations.

Engage CBP through legal counsel if facing transshipment allegations.

Expert Recommendation: "Involve a licensed U.S. Customs Broker or Customs Consultant. This isn’t a DIY situation." |

Short Recap & Next Steps

The U.S. has escalated its use of reciprocal tariffs, targeting over 80 trade partners including the EU and UK. Duties up to 15% now apply to imports that were previously tariff-free. Transshipment is treated as a major violation, triggering punitive 40% duties. If you're a Customs or Compliance Officer, it's time to act—not react.

Start by visiting www.customsmanager.info or book a consultation at www.customsmanager.org.

Sources & Further Information

White House Executive Order (EO 14257)

HTSUS Search Tool

CBP Enforcement Guidance

Who We Are

Customs Manager Ltd. We are your expert customs consultants for EU, UK, and U.S. import, export, and sanctions compliance. Our Trade Intelligence Service at www.customsmanager.info keeps professionals up to speed.

Disclaimer

Please note that the information provided in this article is for general informational purposes only and does not constitute legal, tax, or professional advice. While our aim is that the content is accurate and up to date, it should not be relied upon as a substitute for tailored advice from qualified professionals. We strongly recommend that you seek independent legal and tax advice specific to your circumstances before acting on any information contained in this article. We accept no responsibility or liability for any loss or damage that may result from your reliance on the information provided in this article. Use of the information contained in this article is entirely at your own risk.

#Customs #TradeCompliance #ImportRegulations #ExportCompliance #Tariffs #Transshipment #HTSUS #CustomsConsultant #ComplianceOfficer #USA #UK #EU #ReciprocalTariffs #Sanctions #SupplyChain #ImportDuty #ExportControls #CBP #USTR #ExecutiveOrder #CustomsBroker

Comments